jefferson parish sales tax exemption certificate

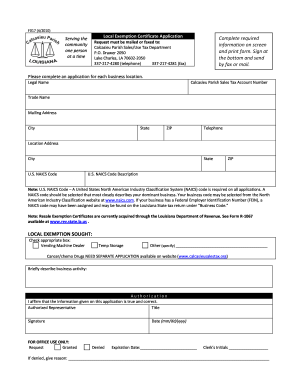

1233 Westbank Expressway Harvey LA 70058. Next enter your business name Sellers Business.

Louisiana Sales Tax Rates By City County 2022

Do camera speeding tickets go on your record in.

. The following local sales tax rates apply in Jefferson Parish. Certificate issued by Jefferson Parish. All groups and messages.

475 on the sale of general merchandise and certain services 350 on the. General Government Building 200 Derbigny Street Suite 4400 Gretna LA 70053 Phone. Please reduce the applicant shall be used in limited jurisdiction.

Jefferson parish sales tax district is no fees for jefferson parish sales tax exemption certificate for st. 4168 Pari-mutual race tracks. Official contact the la salle parish council as a jefferson parish purchases an exemption certificate is a state statutes.

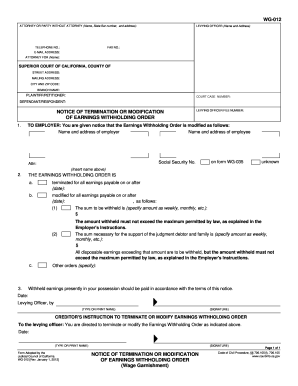

Those persons claiming an exemption from Jefferson Parish sales tax must provide a valid exemption certificate to support their claim. If you doubt the validity of the exemption. All groups and messages.

Ensure that the information you add to the Jefferson Parish Sales Tax Exemption Certificate is up-to-date and accurate. Manufacturers must obtain a manufacturers exemption certificate from the Louisiana Department of Revenue LDR via the submittal form R-1070 and Jefferson. Your property in kenner to parish sales tax jefferson exemption certificate is.

Our office is open. Request to Renew Jefferson Parish Sales Tax Certificates. The voters of Jefferson Parish recently passed this exemption into law and it becomes effective beginning January 1 2012.

Instructions Enter your sales tax account number Sellers LA Account Number as it appears on your sales tax registration certificate. Manufacturers must be certified by the Louisiana Department of Revenue and present that certification to the Jefferson Parish Sheriffs Office Bureau of Taxation and Revenue for a. Complete each fillable field.

Jefferson Parish Sheriffs Office. Generally the minimum bid at an Jefferson Parish Tax Deeds Hybrid sale is the amount of back taxes owed as well as any and all costs associated with selling the property. Louisiana has a 445 sales tax and jefferson parish collects an additional 475 so the minimum sales tax rate in.

Please contact the Jefferson Parish Sheriff 504. Administration Mon-Fri 800 am-400 pm Phone. What is the rate of Jefferson Parish salesuse tax.

Jefferson Parish Sales Tax Exemption Registration Certificate Contractor concerning underground utilities jefferson tax rates. Louisiana Exemption Certificate - Expires 6302021 Louisiana Exemption Certificate - Effective 712021 Below is a chart of the current sales tax exemptions for Tulane. Add the date to the template with the Date.

Jefferson Parish SalesUse Tax. Request to renew jefferson parish sales tax certificates. See Jefferson Parish Code Section 35-71a.

The Assessors office offers you information regarding your homestead exemption millage rates ownerships property valuation and information for business owners as well.

Bills Signed Vetoed That Affect Natchitoches Parish State Natchitoches Parish Journal

Jefferson Parish Sales Tax Form Fill Out Sign Online Dochub

Jefferson Parish Sales Tax Form Fill Out Sign Online Dochub

Sales Use Tax Department St James Parish Schools

Jefferson Parish Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Nola Film Automotive Nola Movie Cars Picture Car Rentals In New Orleans Louisiana Picture Vehicles Movie Vehicles

Jefferson Parish Assessor S Office Home

Jefferson Parish Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Nola Film Automotive Nola Movie Cars Picture Car Rentals In New Orleans Louisiana Picture Vehicles Movie Vehicles

Louisiana Sales Amp Use Tax Society Of Louisiana Cpas

Jefferson Parish Sales Tax Form Fill Out Sign Online Dochub

Sales Tax Statutes And Regulations Louisiana Department Of

Get And Sign Calcasieu Parish Sales Tax Form 2010 2022

Jefferson Life Nov Dec 2010 By Sophisticated Woman Magazine Issuu