fsa health care limit 2021

If you have one child and spent over 8000 for their care in 2021 you can still take advantage of 3000 of expenses 8000 childcare expense limit minus the 5000 of expenses you have already. By Hayden Goethe A dependent care flexible spending account lets participants set aside pre-tax dollars to help pay for dependent care.

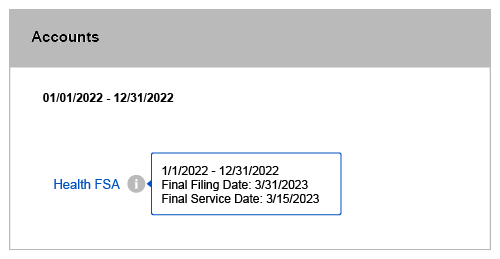

Understanding The Year End Spending Rules For Your Health Account

The contribution limit for a dependent care FSA is 5000 but that may be higher for some plans in 2021.

. What is a dependent care FSA. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples.

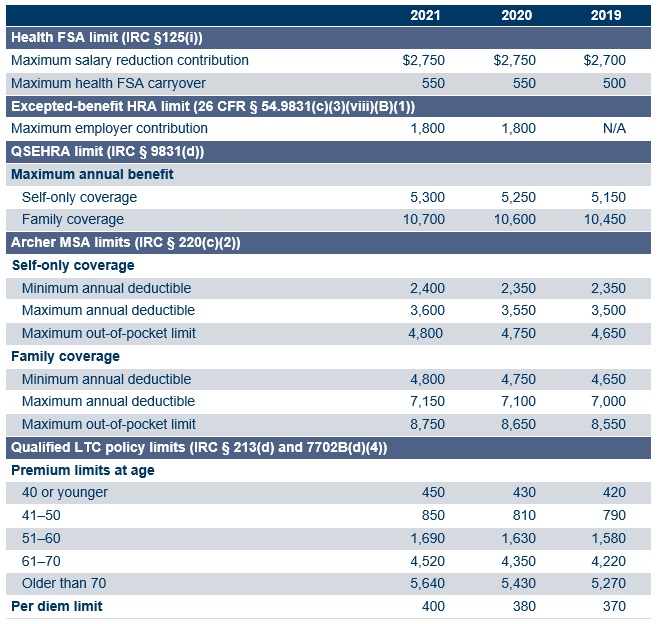

Full FSA Carryovers from 2020-2021 and 2021-2022 Plan Years. For 2022 401k Contribution Limit Rises to 20500 SHRM. The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020.

Sept 3 2021. Dependent Care Flexible Spending Account FSA. Dependent Care FSA Rules Non-Working Spouses Expenses.

Health Flexible Spending Arrangements. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription drugs doctors office co-pays and more. Contributing to this benefit reduces taxable income and spreads the benefits of pre-tax dollars throughout the year helping you save 30 percent or more on your.

For both the health FSA and the dependent care FSA. Shop thousands of FSA Flexible Spending Account and HSA Health Savings Account eligible items at CVS Pharmacy online and in store today. The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan yearTo qualify for this relief you must have been enrolled on or before January 31 2020 and you must have unused amounts from the 2020 plan.

Posted 2021-07-12 July 12 2021. In this situation you should list 16000 for the 3-year-old child and -0- for the 11-year-old child. Annual limit - 5000 per household up to 2500 per spouse for.

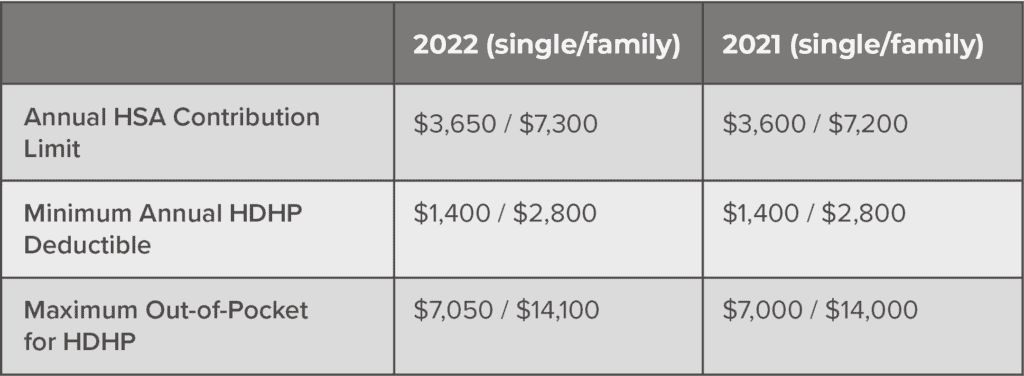

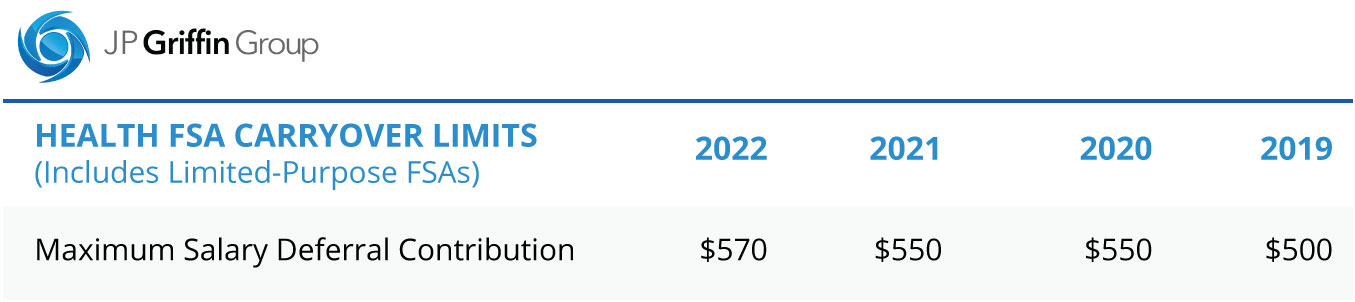

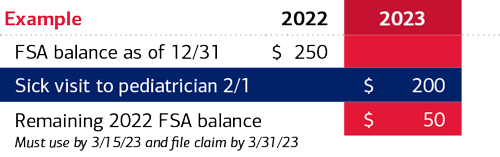

Employer also adopts the increased 10500 dependent care FSA limit for 2021. The limit on annual employee contributions toward health FSAs for 2022 is 2850 up from 2750 in 2021 with the ability to carry over up to 570 up from 550 in 2021. A health FSA may allow an individual who ceases participation in a health FSA during calendar year.

The sticker shock of daycare babysitting or a part-time child care program can cause many parents to panic. The limit on monthly contributions toward qualified transportation and parking benefits for 2022 is increased to 280 up from 270 in 2021. An FSA allows you to pay certain expenses from your pre-tax income rather than after-tax income.

Home Government Financial Assistance Free Health Insurance. Due to the American Rescue Plan Act of 2021 employers have the option to increase the contribution limit to 10500 for 2021 plans. Use flexible spending accounts to pay for health care and dependent care while saving money on your taxes.

The 16000 limit would be used to compute your credit unless you have already excluded or deducted dependent care benefits paid to you or on your behalf by your employer. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in programs that test. Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

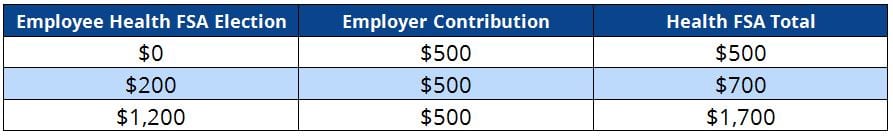

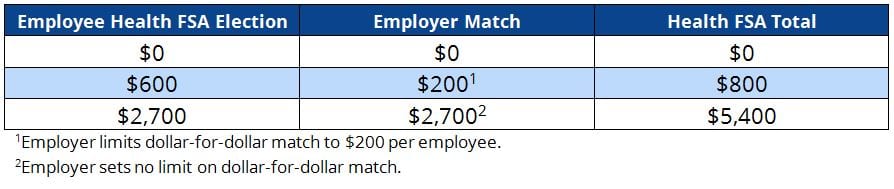

Now the credit goes up to 8000 for one eligible dependent and up. If employers provide health care FSA contributions this amount is in addition to the amount that employees can elect. The maximum carryover amount.

Why to consider enrolling in an FSA. Plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022. Is nearly 16000 according to a 2021 study by the Center for American ProgressThis amount accounts for.

But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021. Health Care FSA. If youre 55 or older you can put an extra 1000 in your HSA.

A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year. September 17 2021 September 16 2021 by Kevin Haney. The average annual cost of center-based infant care in the US.

For 2021 the individual coverage contribution limit is 3600 and the family coverage limit is 7200. Regardless of income bracket the fact is clear child care is expensive. You are here.

Navigating Medicare Part D Can Be Frustrating Once You Understand How To Navigate The Plans Things B How To Plan Retirement Advice Health Insurance Coverage

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Understanding The Year End Spending Rules For Your Health Account

Fsa Contribution Limits 2021 Health Savings Account Personal Budget High Deductible Health Plan

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Hra Vs Fsa See The Benefits Of Each Wex Inc

Can Employers Add To Employee Health Fsa Contribution Core Documents

Can Employers Add To Employee Health Fsa Contribution Core Documents

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Why You Might Want A Flexible Spending Account Uf At Work

Irs Releases Fsa Contribution Limits For 2022 Primepay

Now Accepting United Healthcare Insurance Health Care Insurance United Healthcare Maternal Nutrition

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Irs Adjusts Health Flexible Spending Account Other 2022 Limits

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

Irs Announces 2021 Health Fsa Qualified Transportation Limits Lyons Companies

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Understanding The Year End Spending Rules For Your Health Account