deadline to pay mississippi state taxes

Mississippi offers a 6-month. Property tax deadline passed in Mississippi August 23 2018 WINSTON COUNTY Miss.

Legislature Closes In On Critical Deadline With Bills That Reform The Abc System And State Income Tax Still Alive Press Register

WLBT - Mississippi Department of Revenue announced an extension to tax filing.

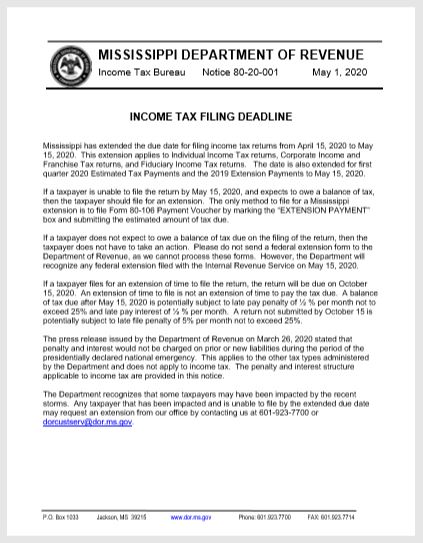

. Updated June 2022 These. The deadline to file and pay 2019 Mississippi individual and corporate income taxes has been extended to May 15. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

If you pay late you may be charged interest of 05. If you need to pay taxes you are required to pay the amount due by April 18 2022. WCBI If youre a property owner in Mississippi its time to pay up.

A tax extension gives you more time to file your return not more time to pay. You need to pay 80 of your taxes by April 18 2022. However tax penalties might apply if you owe taxes and you do not file.

You may owe a higher late-payment penalty if you didnt pay 90 of your tax liability by the April. Mississippi Filing Due Date. Quarterly tax and wage reports can be filed and paid online.

While taxpayers have gotten an extension until July 15 to file their federal taxes theyll only get a one-month reprieve from Mississippi. There is an additional convenience fee to pay through the msgov portal. In responding to the COVID-19 pandemic the state has moved the deadline twice.

How to Make a Credit Card Payment. In March the state moved the deadline to file and pay 2019 individual income tax to May 15. Corporate income and franchise tax returns are due by March 15 or by the 15 th day of the 3 rd month following the end of the taxable year for fiscal year filers.

In march the state moved the deadline to file and pay 2019 individual income tax to may 15 2020. Pay by credit card or e-check. Calculate your Mississippi net pay or take home pay by entering your pay information W4 and Mississippi state W4 information.

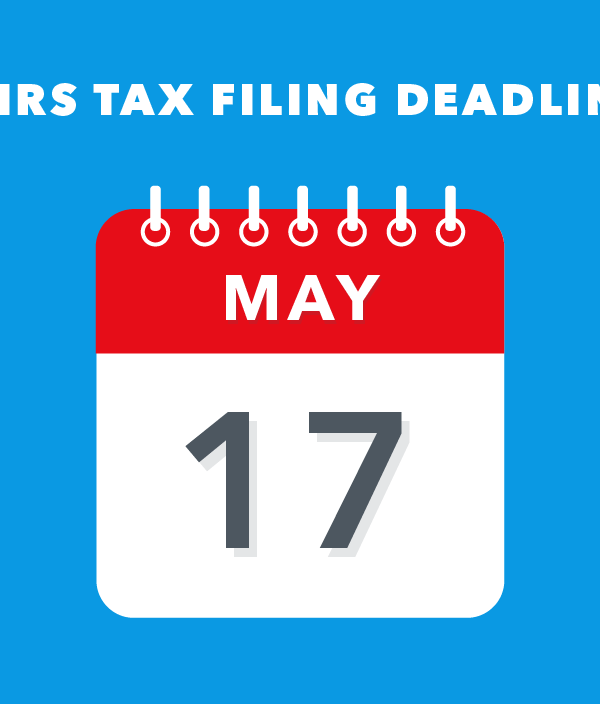

You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or. Mississippi offers a 6-month extension which moves the. This year the IRS tax filing deadline has been extended to Monday.

The last deadline after a tax extension or otherwise to e-file 2022 Tax Returns is October 16 2023. Web The deadline to file and pay 2019 Mississippi individual and corporate. When that date falls on a weekend or holiday filers get until the next business day to submit their state returns.

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Irs Announces Tax Relief For Mississippi Water Crisis Victims

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

Mississippi Dor Reminds Taxpayers That Income Tax Returns Are Due May 15 Cooking With Salt

How To File And Pay Sales Tax In Mississippi Taxvalet

States With The Highest Lowest Tax Rates

/cloudfront-us-east-1.images.arcpublishing.com/gray/AALGER2GJVAPTD3FVYCPHODHBE.jpg)

Miss Tax Reform Bill Faces Deadline Tuesday

Tax Deadline 2020 When Are My State Taxes Due Amid Coronavirus

Deadline Approaches For Mississippi Lawmakers To Pass Tax Reform Legislation

File Ms Taxes With Dept Of Revenue E File Com

Filing Mississippi State Tax Returns Things To Know Credit Karma

9 States With No Income Tax Are They Worth It Parade Entertainment Recipes Health Life Holidays

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Where S My Refund Mississippi H R Block

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi Department Of Revenue Msdeptofrevenue Twitter

Tax Deadline 2021 When Are State Income Taxes Due Check Our List