mobile al sales tax rate 2019

Essex Ct Pizza Restaurants. Restaurants In Erie County Lawsuit.

Sales And Use Tax Rates Houston Org

Oxford AL Sales Tax Rate.

. 2022 List of Alabama Local Sales Tax Rates. Mobile AL Sales Tax Rate. Are Dental Implants Tax Deductible In Ireland.

The 105 sales tax rate in Madison consists of 4 Alabama state sales tax 2 Limestone County sales tax and 45 Madison tax. Opelika AL Sales Tax Rate. What is the sales tax rate in Mobile Alabama.

Income Tax Rate Indonesia. You can print a. 150 rows The Food Service Establishment Tax is an additional one percent 1 sales tax.

Huntsville AL Sales Tax Rate. Phenix City AL Sales Tax Rate. Majestic Life Church Service Times.

There is no applicable special tax. Northport AL Sales Tax Rate. Outside of Alabama and are not subject to Alabama sales tax where the seller is required by the.

Feeling Lost In Life At 50. Pursuant to Alabama Code 40-5-14 on Monday January 24 2022 at 1000 AM the Mobile County Revenue Commission will conduct a Tax Levy Sale of business personal property to collect payment of delinquent personal property taxes owed. Are Dental Implants Tax Deductible In Ireland.

You can print a 105 sales tax table here. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. There is no applicable city tax.

Pelham AL Sales Tax Rate. Monday Tuesday Thursday Friday. Alabama Legislative Act 2010-268.

Beginning with tax year 2019 delinquent properties the Mobile County Revenue Commission decided to migrate to the sale of tax liens. 4 rows Rate. This is the total of state county and city sales tax rates.

You can print a 10 sales tax table here. Restaurants In Matthews Nc That Deliver. Average Sales Tax With Local.

Mobile Al Sales Tax Rate 2019. Delivery Spanish Fork Restaurants. Mobile Al Sales Tax Rate 2019.

Posted January 18 2021 January 18 2021. Opry Mills Breakfast Restaurants. The Alabama sales tax rate is currently.

The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7. For tax rates in other cities see Alabama sales taxes by city and.

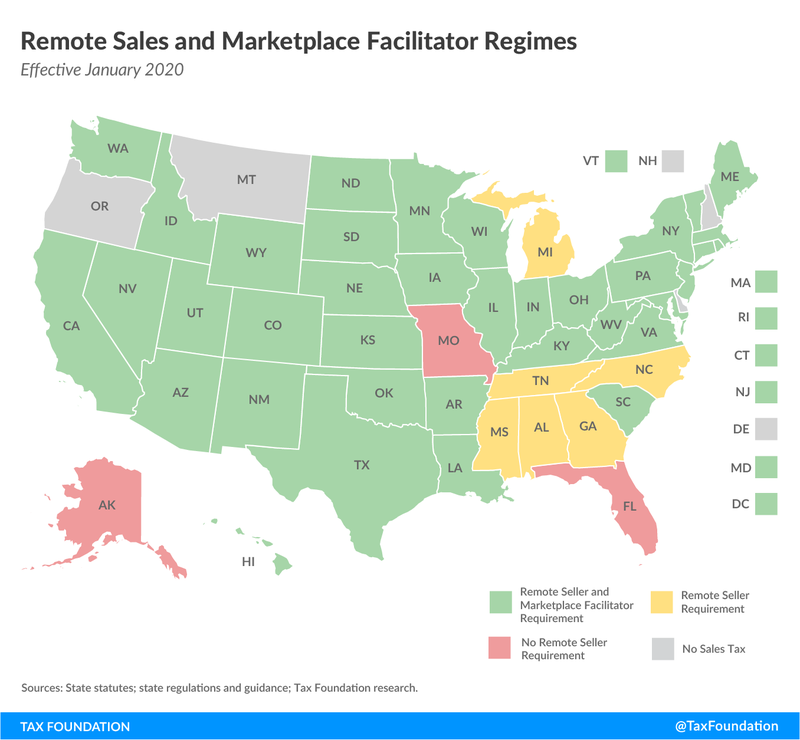

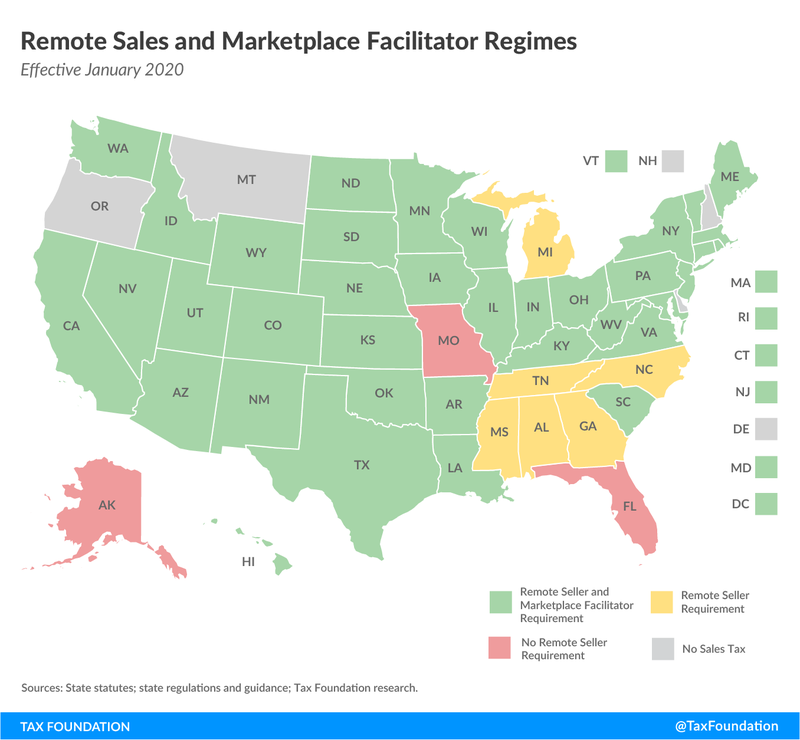

Sales use or lease tax may be collected irrespective of rate. That ranks behind Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent and Washington 917 percent Retail sales taxes are one of the more transparent ways to collect tax revenue according to. The sales tax jurisdiction name is Huntsville which may refer to a local government division.

24 rows sales tax. The Tax Foundation found that Alabama has the nations fifth highest average combined state and local sales tax rates at 914 percent. Cfs Tax Software Order Form.

Montgomery AL Sales Tax Rate. Best Restaurants In Downtown Mobile Al. For tax rates in other cities see Alabama sales taxes by city and county.

The sales tax jurisdiction name is Fairhope Pj which may refer to a local government division. Tax Collector Near Me Brandon. The 8 sales tax rate in Fairhope consists of 4 Alabama state sales tax 3 Baldwin County sales tax and 1 Special tax.

Begränsade öppettider under sommaren samt julhelger. For example a Montgomery. Hoover AL Sales Tax Rate.

1 Guidelines for Automobile Dealers Sales Tax. The tax levy sale will be held at 750 Viaduct Road Chickasaw Alabama 36611 in Mobile County Alabama. The County sales tax rate is.

Majestic Life Church Service Times. Madison AL Sales Tax Rate. Simplified Sellers Use Tax Rate 40-23-193a.

Lowest sales tax 5 Highest sales tax 115 Alabama Sales Tax. The minimum combined 2022 sales tax rate for Mobile Alabama is. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100.

Aroma Indian Restaurant West Palm Beach. There is no applicable special tax. Impingement inklämd sena.

Soldier For Life Fort Campbell.

States Without Sales Tax Article

Study Reveals Most Least Tax Friendly States How California Compares Ktla

Alabama Sales Tax Rates By City County 2022

A Small Business Guide To E Commerce Sales Tax The Blueprint

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax On Grocery Items Taxjar

Cell Phone Taxes And Fees 2021 Tax Foundation

Alabama Tax Revenues Remarkably Resilient In 2020 Public Affairs Research Council Of Alabama

States With Highest And Lowest Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)